With all eyes on COP28 last week in Dubai, the focus of discussion was primarily the energy transition from fossil fuels to renewables. Ahead of the upcoming Commodities Trading Week in Singapore January 24 and 25, 2024, it is important to ask the question is the energy transition in its current trajectory going to result in a healthier planet, better equipped to sustain life and reduce the impacts of climate change?

There is no longer space in the discourse to debate whether climate change is real or not. The science is irrefutable, and the evidence clear with catastrophic climate events increasing year on year, the Centre for Epidemiology in Brussels reporting $USD2.97 trillion in losses between 2000-2020, with 4 billion people affected, resulting from close to 8000 catastrophic climate events. If you’re still a climate denier, you’re on the wrong side of history.

There is no longer space in the discourse to debate whether climate change is real or not. The science is irrefutable, and the evidence clear with catastrophic climate events increasing year on year, the Centre for Epidemiology in Brussels reporting $USD2.97 trillion in losses between 2000-2020, with 4 billion people affected, resulting from close to 8000 catastrophic climate events. If you’re still a climate denier, you’re on the wrong side of history.

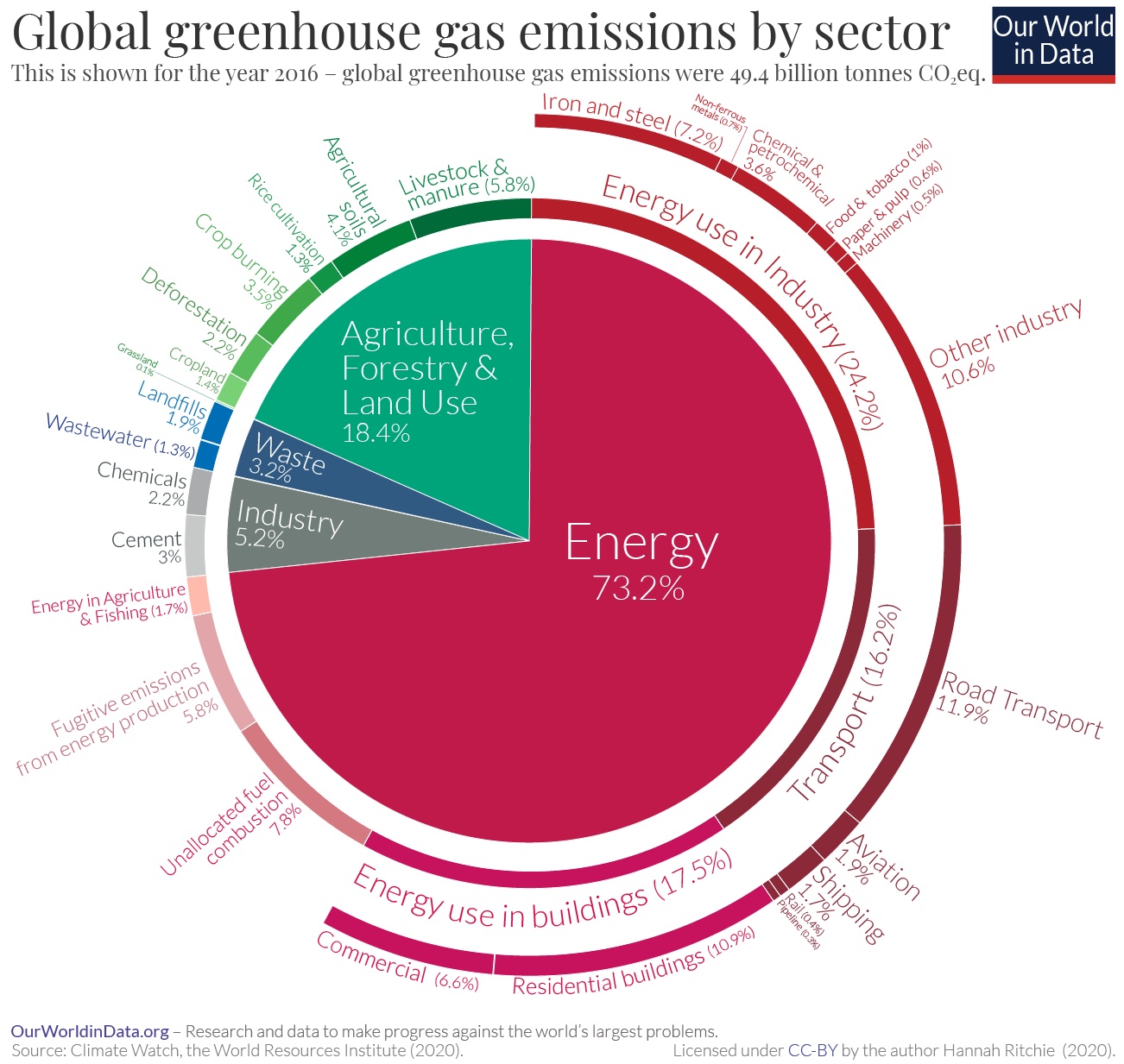

It took a good two decades for governments to heed the warnings of scientists and in 2021, the Pentagon finally released a statement that climate change poses one of the greatest security risks for the next 100 years. Since the Paris Agreement was signed in 2016, there has been back and forth between nation states as to what being a signatory means and what action is to be taken if any. Eventually aligning to the Intergovernmental Panel on Climate Change (IPCC) AR5 report released in 2012, saw nations states beginning to commit to reducing greenhouse gas emissions as the urgently needed action required to cap warming at 1.5 degrees. The reduction of fossil fuels and carbon was interpreted as the core problem and renewable energy considered as the solution. The energy transition emerged shaping government policy and climate action.However, will this lead to the outcomes we hope to see? Will this result in a healthy planet and reduction in atmospheric carbon? Will this forge the path towards net zero?I think not. What is often ignored is the role of commodities in geopolitical and economic power, and politics. Governments and corporations alike have begun to espouse a deep commitment to mitigating the climate crisis. However, it is important to unpack the real dynamics at play to discern whether our current trajectory will deliver the systemic shifts needed to mitigate an existential threat to both business as we know it, and species, including ours.Firstly, climate change is more complex than a fossil fuel and carbon issue alone. It is a dynamic relationship between rapid deforestation, species extinction, cultural extinction, soil extinction, accelerated desertification and increasing global greenhouse gases. The industry responsible for most of these impacts is the commodities sector. This includes energy, oil and gas mining and production, natural resource mining and production, agriculture, timber production and fisheries to name a few.

To confound matters, whilst being the largest contributor to ecological degeneration, the commodities sector is the most susceptible to vulnerabilities due to climate change according to the “Commodities and Development Report 2019: Commodity Dependence, Climate Change and the Paris Agreement” produced by UNCTAD. They state:

“On the one hand, the prospection, production, processing, consumption, and disposal of commodities are among the main sources of anthropogenic greenhouse gas emissions. On the other hand, climate change is a source of important shocks to commodity sectors, posing dire social and economic risks to people and countries dependent on commodities. Although commodity-dependent developing countries (CDDCs) have contributed only modestly to greenhouse gas emissions, they will be strongly affected by the implementation of the Paris Agreement.”

The main source of energy to date has been oil and gas and the main players in this sector have been United States of America, Russia, Saudi Arabia, Canada, and Iraq. For the majority of oil and gas production over the past decades, China has been on the periphery, only reaching the top five in 2023. Since the development of sustainability and green solutions and calls by sustainability pundits to divest in oil and gas, Saudi Aramco reported record profits in 2nd quarter 2022. The truth of the current situation is investors are not divesting; oil remains an important risk hedge for investment portfolios. This is supported also by a recent policy announcement by the United Kingdom’s Prime Minister Sunak, approving over one hundred new oil and gas exploration licenses in the North Sea. This announcement was made shortly after the reveal that 40 oil and gas rigs are to be decommissioned in the next 10 years within the North Sea, so any celebration of the decrease of mining in the North Sea was short lived. This attempt to rebolster a flagging UK economy since its decline post-Brexit, with a recent study by the London School of Economics finding that Brexit is responsible for about a third of UK food price inflation since 2019, adding nearly £7 billion ($8.8 billion) to Britain’s grocery bill. It also notable that the UK has one of the longest net zero trajectories making the promise for 2050. It’s likely that the UK is trying to strengthen its oil and gas production to correct its economic challenges. This begs the question – is there really a transition underway or are we only seeing an emergence of a new and highly profitable industry enabling a race to shift geopolitical power?

Regarding the transition to renewable energy, including solar and wind power, electric vehicles, and biofuels, we will require 400 new mines in critical and rare earth minerals including nickel, lithium, copper, and cobalt in the next 10 years to meet the energy transition targets set by nation states. This is a significant increase in new mines. It is well documented the mining sector is responsible for many negative environmental and social impacts such as deforestation/habitat destruction, pollution, soil erosion, human-wildlife conflict, and the loss of biodiversity. Similarly mining has a high freshwater footprint, when large parts of the world have been in drought for decades including many African nations since the 1908s, Australia since 1994 and Europe more recently since 2017. With energy and commodities being responsible for the largest negative impacts on environment – there really is no shift towards meeting our climate targets in the transition from oil and gas to renewables, especially given we are not seeing divestment from oil and gas.

With oil and gas production expected to increase to maintain economic growth in numerous countries and an a doubling down of the number of critical and rare earth mines on the planet in the next decade, it is reasonable to expect that negative impacts will be exacerbated. This was already supported by the IPCC’s latest report in 2023 finding that despite over $1 trill in impact investing and green investments, our global temperatures have increased by 1.06 degrees Celsius since 2012 and other impacts such as ocean warming, desertification and species extinction worsened.

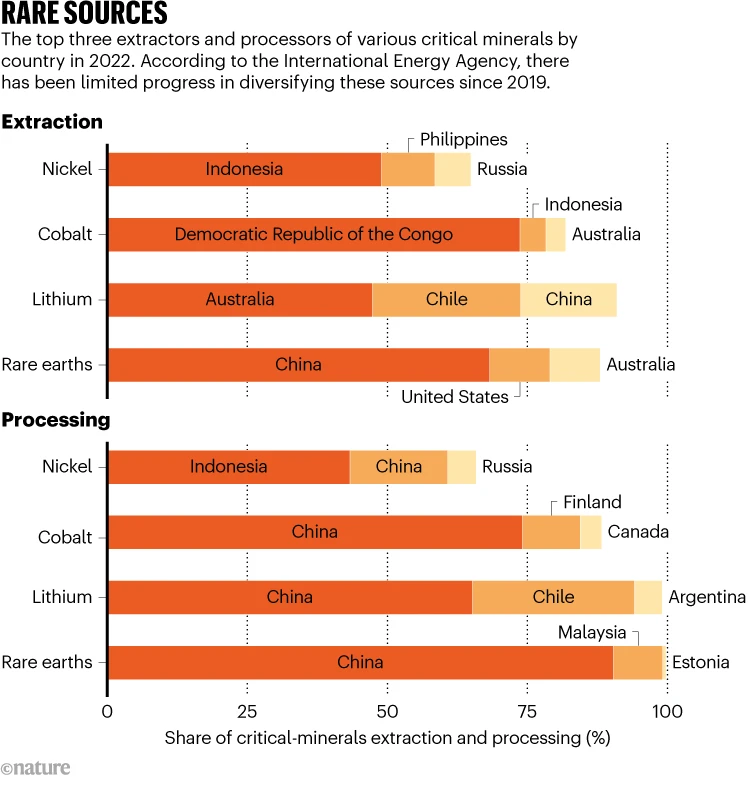

So what is really driving the new minerals race? Geopolitical power is shifting due to increasing commodities demand towards rare earth and critical minerals. Strategic acquisitions by China over the last 20 years has put them in the position where they control the majority of the worlds production of these minerals and a number of the supply chains from the mine through to the delivery of final product.

“On the one hand, the prospection, production, processing, consumption, and disposal of commodities are among the main sources of anthropogenic greenhouse gas emissions. On the other hand, climate change is a source of important shocks to commodity sectors, posing dire social and economic risks to people and countries dependent on commodities. Although commodity-dependent developing countries (CDDCs) have contributed only modestly to greenhouse gas emissions, they will be strongly affected by the implementation of the Paris Agreement.”

The main source of energy to date has been oil and gas and the main players in this sector have been United States of America, Russia, Saudi Arabia, Canada, and Iraq. For the majority of oil and gas production over the past decades, China has been on the periphery, only reaching the top five in 2023. Since the development of sustainability and green solutions and calls by sustainability pundits to divest in oil and gas, Saudi Aramco reported record profits in 2nd quarter 2022. The truth of the current situation is investors are not divesting; oil remains an important risk hedge for investment portfolios. This is supported also by a recent policy announcement by the United Kingdom’s Prime Minister Sunak, approving over one hundred new oil and gas exploration licenses in the North Sea. This announcement was made shortly after the reveal that 40 oil and gas rigs are to be decommissioned in the next 10 years within the North Sea, so any celebration of the decrease of mining in the North Sea was short lived. This attempt to rebolster a flagging UK economy since its decline post-Brexit, with a recent study by the London School of Economics finding that Brexit is responsible for about a third of UK food price inflation since 2019, adding nearly £7 billion ($8.8 billion) to Britain’s grocery bill. It also notable that the UK has one of the longest net zero trajectories making the promise for 2050. It’s likely that the UK is trying to strengthen its oil and gas production to correct its economic challenges. This begs the question – is there really a transition underway or are we only seeing an emergence of a new and highly profitable industry enabling a race to shift geopolitical power?

Regarding the transition to renewable energy, including solar and wind power, electric vehicles, and biofuels, we will require 400 new mines in critical and rare earth minerals including nickel, lithium, copper, and cobalt in the next 10 years to meet the energy transition targets set by nation states. This is a significant increase in new mines. It is well documented the mining sector is responsible for many negative environmental and social impacts such as deforestation/habitat destruction, pollution, soil erosion, human-wildlife conflict, and the loss of biodiversity. Similarly mining has a high freshwater footprint, when large parts of the world have been in drought for decades including many African nations since the 1908s, Australia since 1994 and Europe more recently since 2017. With energy and commodities being responsible for the largest negative impacts on environment – there really is no shift towards meeting our climate targets in the transition from oil and gas to renewables, especially given we are not seeing divestment from oil and gas.

With oil and gas production expected to increase to maintain economic growth in numerous countries and an a doubling down of the number of critical and rare earth mines on the planet in the next decade, it is reasonable to expect that negative impacts will be exacerbated. This was already supported by the IPCC’s latest report in 2023 finding that despite over $1 trill in impact investing and green investments, our global temperatures have increased by 1.06 degrees Celsius since 2012 and other impacts such as ocean warming, desertification and species extinction worsened.

So what is really driving the new minerals race? Geopolitical power is shifting due to increasing commodities demand towards rare earth and critical minerals. Strategic acquisitions by China over the last 20 years has put them in the position where they control the majority of the worlds production of these minerals and a number of the supply chains from the mine through to the delivery of final product.

The impacts of this were demonstrated recently by China’s announcement new export controls on graphite, a key component of lithium-ion batteries, which significantly affects electric vehicle supply chains. If China uses the export controls, which take effect on Dec. 1, to reduce exports of graphite or to favor Chinese-owned companies operating abroad, they effectively control advanced battery manufacturing globally and can dictate the terms of the energy transition in several sectors.

Likewise, Europe is competing for control of production of critical and rare earth minerals and Biden recently announced financial incentives through their “first CHIPS for America funding opportunity for manufacturing incentives to restore U.S. leadership in semiconductor manufacturing, support good-paying jobs across the semiconductor supply chain, and advance U.S. economic and national security.” This has already seen an increase in investment in establishment of manufacturing plants in the US. Whilst The US doesn’t control mining and production of minerals, they are seeking to control the supply chain to final product.

China, Europe, the United States and others are all investing billions of dollars to acquire access to critical minerals in Africa and South America. This is potentially exploitative. The countries in which the minerals are being mined know it, and are sensibly refusing to be used solely to provide raw materials for other people’s batteries, insisting that the processing of minerals into higher-value products happens within their borders, too. Indonesia, for example, has banned the export of nickel ore. Artisinal mining remains a human rights issue in many mines around the world, well documented in the cobalt mines in the Democratic Republic of Congo (DRC), driven by extreme poverty in the country despite that it is the largest cobalt producer in the world. The value from mining practices is highly extractive and not finding its way to local people, as is the case with many mines around the world.

Likewise, Europe is competing for control of production of critical and rare earth minerals and Biden recently announced financial incentives through their “first CHIPS for America funding opportunity for manufacturing incentives to restore U.S. leadership in semiconductor manufacturing, support good-paying jobs across the semiconductor supply chain, and advance U.S. economic and national security.” This has already seen an increase in investment in establishment of manufacturing plants in the US. Whilst The US doesn’t control mining and production of minerals, they are seeking to control the supply chain to final product.

China, Europe, the United States and others are all investing billions of dollars to acquire access to critical minerals in Africa and South America. This is potentially exploitative. The countries in which the minerals are being mined know it, and are sensibly refusing to be used solely to provide raw materials for other people’s batteries, insisting that the processing of minerals into higher-value products happens within their borders, too. Indonesia, for example, has banned the export of nickel ore. Artisinal mining remains a human rights issue in many mines around the world, well documented in the cobalt mines in the Democratic Republic of Congo (DRC), driven by extreme poverty in the country despite that it is the largest cobalt producer in the world. The value from mining practices is highly extractive and not finding its way to local people, as is the case with many mines around the world.

If we tell the truth and acknowledge that the public policy driving the energy transition has more to do bolstering economies, capitalizing off a new and profitable industry and a battle among nation states for global economic power, and very little to do with mitigating the climate crisis what do we do? This is the geopolitics of the clean energy transition.

It is essential we find a way to reduce carbon and other GHG’s in the atmosphere, I am not debating the necessity of this, but this alone will not solve the climate crisis. The factors and dynamics are too complex for a single or sector focused approach. There is too much degeneration on the planet that needs to be healed and the impotence of conventional impact investing, sustainability, green and Environmental Social Governance (ESG) initiatives are resulting in a failure to meet the systemic impacts required to have any significant mitigating effect on the climate change threat.

The opportunity now is to explore regeneration as a framework for development and design. Regeneration is a way of investing, doing business and governance that follows living systems principles and creates conditions for all of life to thrive. We measure these impacts across economy, ecology, society and culture / heritage. A recent study undertaken by Henmil Group Family Office, a family office that specializes in regenerative investing, across over 1000 regenerative projects and practitioners globally found only a very small handful were:

– Trained in regeneration

– Worked with regenerative principles and frameworks

– Had a clear methodology

– Have delivered regenerative results over time

Most were in fact confusing regeneration with green, sustainability, circular economy and restorative distinctions. This is problematic as most green, sustainable, and circular initiatives have failed to garner systemic results which are required to mitigate risk. Whereas over 25 years of regenerative practice across sectors has proven to deliver superior return on investment and impacts of a more systemic nature compared to conventional approaches. Confusing the distinctions diminishes the power of regenerative investing, by applying the label “regenerative” to sustainability and green the understanding of the real power regeneration has.

Regenerative investing, business and governance is underpinned by a set of 10 principles and over 30 regenerative frameworks, emerging over 100 years of developmental thinking from theorists such as George Gurdjieff, J.G. Bennett and David Bohm and then brought into practice by a chemical engineer for Proctor and Gamble, Charles Krone in the 1960’s. He in turn mentored Carol Sanford, arguably the leading regenerative practitioner for corporations; Regenesis Inc, the unsung pioneers of regenerative agriculture and regenerative transition of places, led by Ben Haggard, Pamela Mang and Bill Reed. Bill also developed the LEED rating system for green buildings. Terra Genesis collaborated with Regenesis Inc to bring the principles and frameworks of regenerative transition to land projects and JET Group, and its principal investor Henmil Group Family Office took this regenerative transition work to scale for whole corporations, funds and investor portfolios and whole places, including villages, cities, regions and a frameworks for development for nation states, trumping the conventional sustainable development approach. Henmil Group, collaborated with its venture studio Transcendent Media Capital and Regenesis Inc to design an Embodied Regenerative Leaders Certification for leaders across governance, corporations and banking and investment to elevate the standard of regenerative practice and investing, putting an end to anyone being able to use the term regeneration in their bio without actually having any working knowledge of the principles and frameworks necessary to deliver the work with integrity.

Numerous case studies across sectors including infrastructure investment, real estate, energy, corporations, towns and cities to name a few are referenced in literature over the past 25 years so why are policy makers blind to the potential to do real transition work that creates the conditions for all of life to thrive? I believe it’s because we still live in a world that is convinced there is a trade-off between economic prosperity and impact. Rather than challenge this perception, the energy transition is fraught with conflict of interest, economic and power politics and a game of smoke and mirrors – effort primarily spent on creating the illusion of change rather than doing the real work. When it comes to money and power, the world is incredibly afraid of loss, that maintaining the status quo becomes the priority. This is also the reason when you work to understand the investment thesis of many impact venture capital funds, they will tell you “We only invest in climate tech”. Well climate technology most certainly won’t solve climate change, nor really put a dent in it to be honest, with the majority of technology solutions reliant upon the very minerals we need to extract from the earth that is largely responsible for the crisis in the first place. Rather this is a way of comfortably investing in technology, which VC’s have been doing for decades, they don’t have to explore the unknown or take added risk, and they paint their investments with the illusion of impact. Win / win for them and their LP’s, they get to play safe, investing in ways they’ve always done, whilst patting themselves on the back reassuring each they are doing good – not so much a win for the planet, however.

As I always tell my children, we must start from a basis of truth, even if it is uncomfortable and sometime ugly, or there is no real way to move forward. Designing and developing climate solutions under the illusion of doing good, when really what is driving the show is a race for a new economic geopolitical order, a fight for the domination of power over the future of energy and risk avoidance by maintaining the status quo when it comes to investment, will not garner us results. Quite frankly, we are running out of time.

Let’s put some numbers to the failure rates. The average failure rate, in terms of return on investment globally across mergers and acquisitions, digitisation projects, organisation change projects, venture capital (VCs) and other private equity investment is 70%. If we add the global economic cost due to failed impact investment in terms of increasing catastrophic climate events and loss of ecosystems services annually, we find that it amounts to over $USD 6 trillion per year. That is a lot if failed investment. What if we put that money into a regenerative approach to transitioning corporations, investor portfolios and places which has proven to have an 85% success rate over 25 years with measures across ecology, economy, society and culture and heritage? What would our world look like?

I have seen intergenerational drought ridden land in Ethiopia, with soil as hard as rock and no vegetation, food or water for kilometres, restored within five years. Impacts included increased precipitation, decrease in temperature by two degrees, fresh running water in the streams, restored soil biomass and vegetation and food security and animal life and improved population health and education as well as jobs creation. The work of Regenesis Inc and JET Group have done proves that it only takes 6-8 years for a small city to become fully regenerative, with outcomes such as new industry development, restored natural ecosystems, improved health and education, economic prosperity, reduced crime rates and unhoused challenges to name but a few. The United States with a burgeoning homelessness crisis of over 600,000 unhoused people across the country, despite millions of dollars being poured into unsuccessful affordable housing projects, could take a leaf out of this book. Carol Sanford successfully supported DuPont to transform the paper production industry, significantly cleaning it up, by using regenerative frameworks to understand the essence their once unprofitable hydrochloric acid production. Together they found a new and profitable role for it in the invention of desktop publishing paper. The product became non-displaceable in the supply chain – significantly more powerful than traditional corporate consulting approaches of attempting to find a “Unique Selling Proposition”. Terra Genesis was able to apply the principles and frameworks to a degraded gold mine in Ghana assisting local people, investors, and village chiefs to develop a new biofuel industry that allowed for the restoration of local waterways, vegetation, and fauna.Let’s be brave enough to invest in regenerative mining, and regenerative funds that actually are designed from the frameworks, let’s educate ourselves in how regenerative frameworks can shape our governance and traceability strategies. Let’s have the principles and frameworks of regeneration shape our master planning and city development. Then we will see fast, significant and profitable results while radically mitigating the climate crisis.

It is essential we find a way to reduce carbon and other GHG’s in the atmosphere, I am not debating the necessity of this, but this alone will not solve the climate crisis. The factors and dynamics are too complex for a single or sector focused approach. There is too much degeneration on the planet that needs to be healed and the impotence of conventional impact investing, sustainability, green and Environmental Social Governance (ESG) initiatives are resulting in a failure to meet the systemic impacts required to have any significant mitigating effect on the climate change threat.

The opportunity now is to explore regeneration as a framework for development and design. Regeneration is a way of investing, doing business and governance that follows living systems principles and creates conditions for all of life to thrive. We measure these impacts across economy, ecology, society and culture / heritage. A recent study undertaken by Henmil Group Family Office, a family office that specializes in regenerative investing, across over 1000 regenerative projects and practitioners globally found only a very small handful were:

– Trained in regeneration

– Worked with regenerative principles and frameworks

– Had a clear methodology

– Have delivered regenerative results over time

Most were in fact confusing regeneration with green, sustainability, circular economy and restorative distinctions. This is problematic as most green, sustainable, and circular initiatives have failed to garner systemic results which are required to mitigate risk. Whereas over 25 years of regenerative practice across sectors has proven to deliver superior return on investment and impacts of a more systemic nature compared to conventional approaches. Confusing the distinctions diminishes the power of regenerative investing, by applying the label “regenerative” to sustainability and green the understanding of the real power regeneration has.

Regenerative investing, business and governance is underpinned by a set of 10 principles and over 30 regenerative frameworks, emerging over 100 years of developmental thinking from theorists such as George Gurdjieff, J.G. Bennett and David Bohm and then brought into practice by a chemical engineer for Proctor and Gamble, Charles Krone in the 1960’s. He in turn mentored Carol Sanford, arguably the leading regenerative practitioner for corporations; Regenesis Inc, the unsung pioneers of regenerative agriculture and regenerative transition of places, led by Ben Haggard, Pamela Mang and Bill Reed. Bill also developed the LEED rating system for green buildings. Terra Genesis collaborated with Regenesis Inc to bring the principles and frameworks of regenerative transition to land projects and JET Group, and its principal investor Henmil Group Family Office took this regenerative transition work to scale for whole corporations, funds and investor portfolios and whole places, including villages, cities, regions and a frameworks for development for nation states, trumping the conventional sustainable development approach. Henmil Group, collaborated with its venture studio Transcendent Media Capital and Regenesis Inc to design an Embodied Regenerative Leaders Certification for leaders across governance, corporations and banking and investment to elevate the standard of regenerative practice and investing, putting an end to anyone being able to use the term regeneration in their bio without actually having any working knowledge of the principles and frameworks necessary to deliver the work with integrity.

Numerous case studies across sectors including infrastructure investment, real estate, energy, corporations, towns and cities to name a few are referenced in literature over the past 25 years so why are policy makers blind to the potential to do real transition work that creates the conditions for all of life to thrive? I believe it’s because we still live in a world that is convinced there is a trade-off between economic prosperity and impact. Rather than challenge this perception, the energy transition is fraught with conflict of interest, economic and power politics and a game of smoke and mirrors – effort primarily spent on creating the illusion of change rather than doing the real work. When it comes to money and power, the world is incredibly afraid of loss, that maintaining the status quo becomes the priority. This is also the reason when you work to understand the investment thesis of many impact venture capital funds, they will tell you “We only invest in climate tech”. Well climate technology most certainly won’t solve climate change, nor really put a dent in it to be honest, with the majority of technology solutions reliant upon the very minerals we need to extract from the earth that is largely responsible for the crisis in the first place. Rather this is a way of comfortably investing in technology, which VC’s have been doing for decades, they don’t have to explore the unknown or take added risk, and they paint their investments with the illusion of impact. Win / win for them and their LP’s, they get to play safe, investing in ways they’ve always done, whilst patting themselves on the back reassuring each they are doing good – not so much a win for the planet, however.

As I always tell my children, we must start from a basis of truth, even if it is uncomfortable and sometime ugly, or there is no real way to move forward. Designing and developing climate solutions under the illusion of doing good, when really what is driving the show is a race for a new economic geopolitical order, a fight for the domination of power over the future of energy and risk avoidance by maintaining the status quo when it comes to investment, will not garner us results. Quite frankly, we are running out of time.

Let’s put some numbers to the failure rates. The average failure rate, in terms of return on investment globally across mergers and acquisitions, digitisation projects, organisation change projects, venture capital (VCs) and other private equity investment is 70%. If we add the global economic cost due to failed impact investment in terms of increasing catastrophic climate events and loss of ecosystems services annually, we find that it amounts to over $USD 6 trillion per year. That is a lot if failed investment. What if we put that money into a regenerative approach to transitioning corporations, investor portfolios and places which has proven to have an 85% success rate over 25 years with measures across ecology, economy, society and culture and heritage? What would our world look like?

I have seen intergenerational drought ridden land in Ethiopia, with soil as hard as rock and no vegetation, food or water for kilometres, restored within five years. Impacts included increased precipitation, decrease in temperature by two degrees, fresh running water in the streams, restored soil biomass and vegetation and food security and animal life and improved population health and education as well as jobs creation. The work of Regenesis Inc and JET Group have done proves that it only takes 6-8 years for a small city to become fully regenerative, with outcomes such as new industry development, restored natural ecosystems, improved health and education, economic prosperity, reduced crime rates and unhoused challenges to name but a few. The United States with a burgeoning homelessness crisis of over 600,000 unhoused people across the country, despite millions of dollars being poured into unsuccessful affordable housing projects, could take a leaf out of this book. Carol Sanford successfully supported DuPont to transform the paper production industry, significantly cleaning it up, by using regenerative frameworks to understand the essence their once unprofitable hydrochloric acid production. Together they found a new and profitable role for it in the invention of desktop publishing paper. The product became non-displaceable in the supply chain – significantly more powerful than traditional corporate consulting approaches of attempting to find a “Unique Selling Proposition”. Terra Genesis was able to apply the principles and frameworks to a degraded gold mine in Ghana assisting local people, investors, and village chiefs to develop a new biofuel industry that allowed for the restoration of local waterways, vegetation, and fauna.Let’s be brave enough to invest in regenerative mining, and regenerative funds that actually are designed from the frameworks, let’s educate ourselves in how regenerative frameworks can shape our governance and traceability strategies. Let’s have the principles and frameworks of regeneration shape our master planning and city development. Then we will see fast, significant and profitable results while radically mitigating the climate crisis.

If we walk the sustainability and green path, we will struggle to get to net zero by 2050 because we are essentially attempting to maintain the status quo without making things worse. If we make a genuine commitment to real regenerative transitions, we can achieve this in less than a decade. First, we must tell a hard truth – the energy transition in its current trajectory will not lead to a healthy planet. Then we can start to imagine a new and regenerative path forward