Family Office’s (FO), the investment companies of ultra-high net worth and high net worth families, have grown in popularity with approximately 3,000 to 6,000 estimated to exist across the USA today and global numbers reaching 20,000. 1,500 family offices we recorded in Singapore by the end of 2022, managing around S$90 billion (US$66.8 billion) worth of assets. According to Bloomberg, family offices control an estimated $6 trillion for the ultra-rich globally. The CAGR for Family Offices is expected to be about 7.5% annually, and with many of the multi-generational family offices handing over to the next generation, we are seeing some of the largest wealth transfers in history. So why is the role of the family office significant in the future of investing?

Let’s look first at the quandary we face in our systems from a global perspective that put future wealth at risk. We are at the precipice of change that we are unlikely to alter the course of. In the twenty years between 2000 – 2020, we have seen close to 8,000 catastrophic climate events, affecting 4 billion people globally and costing the global economy $USD 2.97 trillion. We are seeing these catastrophic events increasing in number, frequency, and severity around the globe. Despite dire warnings from the Intergovernmental Panel on Climate Change (IPCC) in their “1.5-Degree Special Report” in 2018, which won them the Nobel Peace Prize alongside Al Gore, we have seen a 1.06 degree increase in global warming since 2012. We will not cap warming to 1.5 degrees as recommended in the IPCC’s original report, we have missed that opportunity to course correct. Pundits have adjusted their promise to a 2-degree target, but the reality is we are on a trajectory for 3.2 degrees. Why is this an issue and what does it have to do with families and the future of investing? Well, we find ourselves facing an intractable global challenge. Our entire economic system is, in essence, built on commodities. Namely, the resources we extract from the earth, including oil and gas, minerals, agriculture and timber and fisheries. All of these “Ecosystem Services”, defined as the “direct and indirect contributions ecosystems (known as natural capital) provide for human wellbeing and quality of life” are sourcing our global monetary systems as well as industry supply chains.We see correlations between currency and commodities. For example:Copper has shown a close correlation with the Australian dollar and US dollar of late, and the metal’s big drop off its holiday highs could hint at more weakness to come in AUD/USD. There is also correlation between brent crude and the Norwegian Krone as brent crude forms 18% of Norway’s GDP from their oil extraction operations in the North Sea. There is also a strong negative correlation between USD and gold. Gold is priced in US dollars, so its price is significantly dependent on the strength of the currency. When the USD rises, the price of gold falls and vice versa.We also see commodities sourcing the supply chains of many of the industries our economies are built upon. Due to the correlations between commodities and currency, commodifies deeply affect our finance and banking sectors. Technology investments all rely on commodities, with raw minerals providing the materials for hardware and technical infrastructure. Likewise, our consumer industries, manufacturing, energy, transport and logistics, the infrastructure of our cities and public services and health sectors are deeply dependent on the resources we extract from the earth. The problem with this dependency is that commodities have the biggest negative impact on our ecological systems and contribute the most, alongside energy, towards global warming, species extinction, desertification, ocean warming, pollution, cultural and biodiversity loss and our freshwater shortages – in addition to all of the other complexities of ecological degeneration resulting in climate change. However, commodities are also the most susceptible to interruption, damage and destruction due to catastrophic climate events.

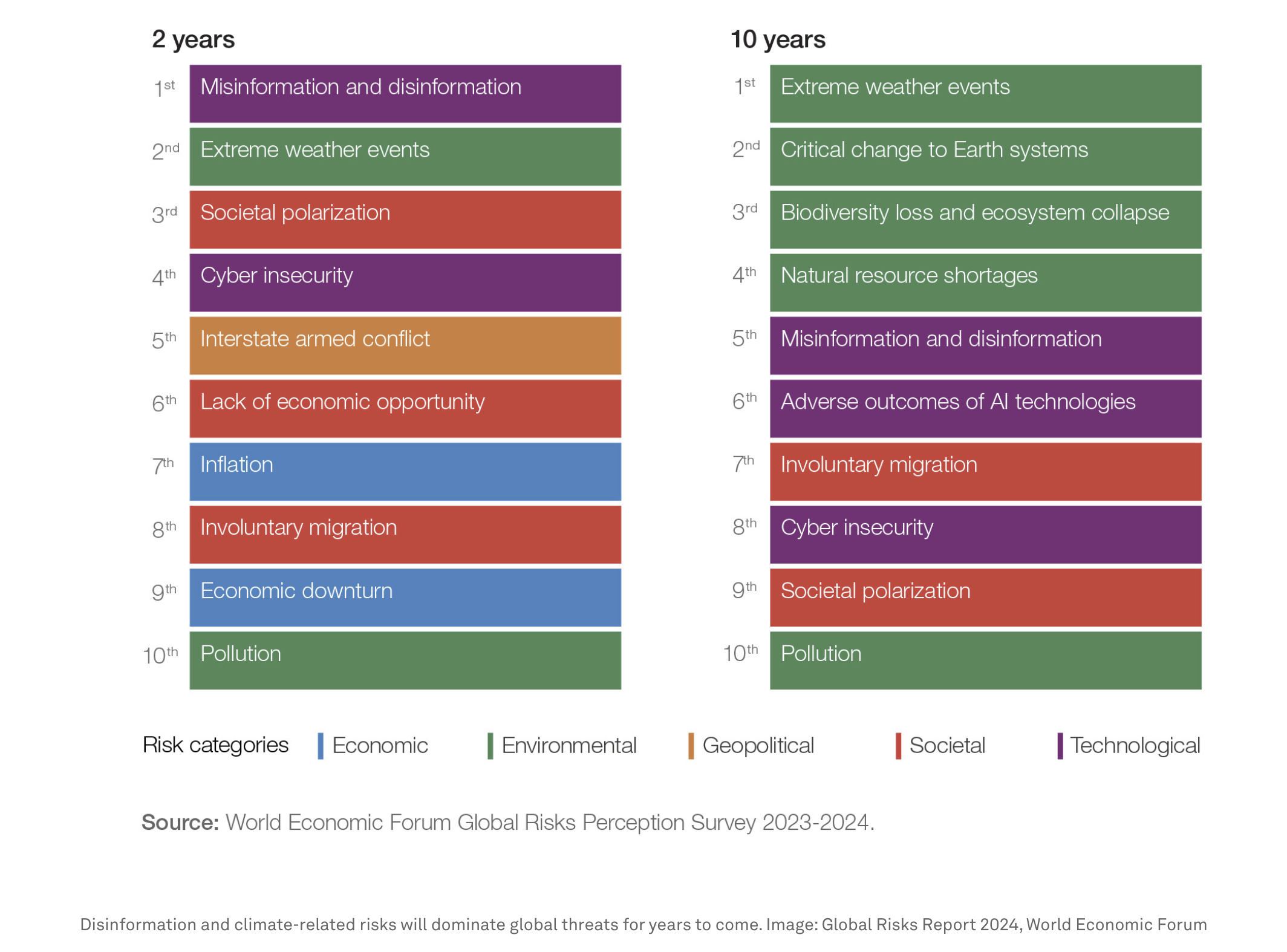

Ahead of the World Economic Forum this week in Davos, WEF researchers released their Global Risks Report which illustrated the top 10 global risks in the next 2 years compared to that of the next 10 years.In the regenerative work I’ve undertaken over the years, I’ve learned that a key contributing factor to societal polarization is decline in quality of life, that is, fundamental and survival needs are not being met, such as access to housing, food and healthcare to name a few. All of these needs are sourced in the distribution and availability of commodities sourced goods and services. Likewise, interstate armed conflict is often a fight between territories in an attempt to control resources (commodities). Russia’s invasion of the Ukraine was largely driven by an attempt to control agricultural production and distribution in Europe. As resources become scarcer or disrupted due to large scale climate events, (remember it wasn’t that long ago there was a run-on toilet paper in supermarkets due fears of long term shortages resulting from the Covid pandemic), polarization, civil unrest and interstate conflict will increase. I believe these deep interconnections to commodities which, WEF identified implicitly in their top four risks within the next 10 years being – extreme weather events, critical changes to earth systems, biodiversity loss and ecosystem collapse and natural resource shortages – are all essentially categories we regard as commodities or risks that heavily affect our access to commodities. Commodities, otherwise known as ecosystems services, which the OECD recently valued at between $USD 125 -140 trillion (US dollars) per year. This is inching towards 1.5 times our global GDP! So, the WEF risk report underestimates polarization and civil unrest and the potential for increased interstate conflict as severe risk factors moving forward.Some countries are more susceptible to these risks than others. By April 2022, food inflation in Malta stood 1.2 percentage points higher than that in the euro area. Malta imports around 70% of its food products and is therefore particularly susceptible to developments in international food prices, and other commodity prices that affect food production as well as transport costs.Given the global market cap of the impact investing currently stands at $USD 1.16 trillion, and the majority of impact funds are being poured into so-called climate solutions, why are we not seeing any impacts or de-risking of these systemic challenges that not only put our future wealth at risk, but our very existence? Rather we are seeing a rapid worsening of conditions. The reason is conventional approaches to impact investing functions from the same extractive paradigm as conventional investing – with just a little bit of impact sprinkled in the mix. Why do so many green and sustainable funds and venture capitalists invest in climate tech or clean tech? Tech is familiar and makes money but ultimately keeps us in the same vicious cycle dependency on the extraction of commodities. We need to mine more causing more environmental degradation to build the tech to solve the issue of environmental degradation. Surely it doesn’t take Albert Einstein to identify this as madness! This investing insanity provides a unique opportunity for family offices.

Family Offices are well positioned to drive their $USD 6 trillion of investable capital into interrupting conventional and impact investing’s pattern of degeneration. Family Offices care about legacy wealth, the wealth of their future generations of families, their grandkids, and great grandkids and so on. Some Chinese family offices have investment runways of 1000 years! This caring commitment has a very different paradigm potential than conventional investors that want an exit in 5 years at 10x multiples and are only concerned about banking the next million, irrespective of the impact. This conventional approach is known in the investment world as an “opportunistic investment thesis” and is he basis for most funds, venture capital investors, even many of our pension funds as well as many old school family offices.So, we live in a world that is dependent on commodities – there is no way out of this any time soon, but the way in which we “do” commodities can transform. This is where regenerative investing is an opportunity for Family Offices to lead in investing in ways that can radically shift the future risk landscape. Families need to be willing to look beyond the short termism of the opportunistic investment thesis which means also looking beyond the opportunistic asset managers of the old guard such as JP Morgan and Goldman Sachs. They know very little about sustainability and nothing about regenerative investing. We cannot rely on the investment leaders who blindly led us into climate catastrophe over decades of opportunistic investing to to be the ones to safely navigate us out. Turning away from conventional “experts” may feel like a risk, but not nearly as big a risk to future wealth as ecosystem collapse. Often, the reason conventional economists and asset managers undervalue climate risk on future asset value is they don’t understand the difference between climate and weather to start with, but they also don’t understand the rapid shifts we are seeing in the word. Rather, they are used to working within a small neo-classical economics paradigm with a set of economic truths and principles based in competition and continuous growth, which are now being proven deeply fallible by climate change. We can no longer extricate commodities from their nature-based context and simply relate to them as a thing to trade. The nominalization and commoditization of our relationship to living systems has resulted in these catastrophic conditions emerging. These advisory firms are not well positioned to navigate families though the kinds of risks facing us over coming decades.The proven and effective alternative is regenerative investing, which is place based, rather than sector based, and has a clear set of systematics frameworks and principles which form a methodology which has been tried and tested over the past 25 years. Contrasting the global failure rate of conventional approaches to investing of 70%, regenerative investments that utilize regenerative frameworks and methodology as the basis for their investment theses and inform the strategy behind the design and development of the assets themselves, there has been a success rate of between 70-80% across measures of ecology, economy, society and culture / heritage. This has been evident across investment sectors which include the most frequent types of investments for families, such as infrastructure, real estate, direct investments and private equity and geographies including LATAM, Asia Pacific, Africa, Europe and the US. However, in a recent study of over 1000 people and projects claiming to do regenerative work, only a small handful were trained in the regenerative methodology, and most were confusing regeneration with restoration, green, circular, or sustainable concepts. They are distinctively different models and not at all interchangeable. Green, sustainable and circular underpin most of the conventional impact investing approaches and contribute to the high failure rates. Saying you’re working in regeneration with no training in the methodologies is akin to saying you’re a doctor without having ever studied medicine or completed a PhD and both have to potential to lead to loss of life – given our current species and biodiversity extinction rates.Regenerative investing methodologies work from a living systems paradigm and unveils the understanding of patterns that are unique to the potential of a place. Investors are investing in the unlocking of potential, rather than the current mindset of taking a problem out of its context and trying to solve for it. This fragmentation of thinking largely contributes to degenerative effects. Place based or regenerative investing is diversified as there arises in the process, opportunities to invest across sectors including commodities, direct assets, private equity, natural capital, technology, real estate, infrastructure and more. The multiples exist across financial and impact returns and impact is measured across the nested system in both spatial and temporal measures. Let’s look at a real-life example.

Real estate investment, Playa Viva in Mexico, worked under the guidance of experienced regenerative practitioners who work with the frameworks. During the process, before designing anything with architects and engineers, the team, including the investors, engaged the community of the neighboring village. They worked with the “Story of Place” – an essential element to the regenerative methodology. The team identified through this process and the integration of other regenerative frameworks, the natural rhythms and cycles of the place, the essential patterns across the ecological, social, economic and cultural landscapes. Working with this deepened understanding, they were able to design a resort that was truly unique, that also established new economies for the local people, driven largely by locals as the stewards. They quality of education and health care improved, and the ecology was restored and began to flourish. Playa Viva launched its offering in 2009 at a less than ideal time – during the financial crisis, cartel wars in Mexico and a SARS outbreak and were still successful! People became more prosperous, and life began to thrive again. Since 2009, the resort has continued to regenerate value and opportunity over time, the village has grown, attracting the young people back to the village from the cities. All of life has continued to thrive, which is the essence of regenerative investing. Investors are happy, communities and ecologies are all prospering and continuing to co-evolve together.Another example took place in Ethiopia, a community that had been drought stricken since the 1980’s. The earth was as hard as rock, with no biomass availability to grow food and no available fresh water sources. Women had to walk kilometers to access water. In five years, by applying the regenerative methodologies, this place had restored the plant life, wildlife returned, biomass in the soil restored, communities were able to grow food again, there was fresh running water in the streams. Due to working with the whole system, precipitation and rainfall increased and the average temperature actually decreased by 2 degrees! People could earn livelihoods again by engaging with the land in new ways, education and health improved significantly – all by working to understand the patterns of the place that existed prior to the decline and working with the inherent potential of the place. This only took five years! If regeneration were to form the basis of the thesis of family office investing, the results would prove to larger investors, such as our pension funds and governments, the power of the methodology. Regenerative investing can get participating places to net positive in less than a decade and protect assts from macroeconomic shocks like catastrophic climate events, financial downturns and ecological collapse. Even social polarization is resolved, as proven in the regenerative $CAD 7 billion wastewater treatment plant, on Iona Island in British Columbia. After decades of conflicts and millions spent in legal fees, the regenerative process resolved the conflict between the government and indigenous peoples, transforming it into a productive and harmonious collaborative relationship. Let us be brave enough to invest in regenerative mining, where mining doesn’t solely extract, but serves to contribute to all of life thriving. We need investors who care – who can drive the direction of boards and C-Suite. Boards and C-Suite are trapped by fear of disappointing investors and therefore stick within the status quo. Regenerative investors have the ability to unlock the innate potential for human creativity and caring, which cannot be replicated by AI or technology. Families’ investments can be profitable and contribute profoundly to systemic impact and in doing so, protect the legacy of their future generation’s wealth, as well as creating a more thriving world for future generations to be born into.

Peta Milan is Principal of Henmil Group Family Office and pioneer of the Embodied Regenerative Leaders Certification for men and women who lead corporations, investments, and public offices: a professional accreditation in regenerative business, investing and governance. Peta works with family offices and other investment leaders to help them safely navigate a transition into regenerative investing. To learn more about regenerative investing contact peta.milan@henmilgroup.com or visit www.petamilan.com or www.jet-group.io